American Housing and the Great Crash

The global financial crisis happened because the US, by failing to oversee lending markets, recklessly let a housing bubble develop. When it popped the whole world, having bought into the bubble through securitized mortgages, fell too. Right?

Think again. Oh, it's true that the US housing market developed a bubble. As I have noted here , that is because of the politicization of housing loans by the federal government, which made lenders' job difficult. But it is also true, as I've argued here, that the crash is more likely a function of the global boom that unfolded, depending on one's preferred starting point, in 1982, 1991 or 1998. This boom was profound, changing hundreds of millions of lives, but ended the way such booms always do, with a backlog of mistaken ventures in need of cleaning out. At worst, the U.S. housing bubble was nothing more than the needle that popped the bubble that particular day.

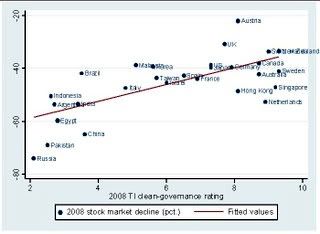

Can this be? Below is a chart that links two numbers. On the vertical axis is the percentage fall in stock markets around the world in 2008. On the horizontal is the country's rating for clean governance by Transparency International, an anti-corruption group.

">

">

Note the close relationship between lack of transparency (i.e., more corruption) and the size of the fall. Indeed, the correlation between the two quantities for the 28 countries I arbitrarily chose (because market data were easily available) is 0.69, which in social science is very large.

So what does it mean? In any society economic actors make mistakes relative to what they know after the fact. In societies with a lot of corruption (which masks information, because each government bribe is by construction hidden from the investing public) or with miserable accounting or other problems with financial information the number of such mistakes over any interval is larger. Thus, this crash is a major cleaning out of a large pile of accumulated mistakes, not an outburst of irrationality or the residue of some strangely unprecedented spasm of greed. The correlation would undoubtedly be even more impressive if it used the quality of financial reporting and information instead of overall government transparency, but is very informative as it is.

For more evidence that this is a rational resolution of a rational bubble (driven by the emergence of many countries with great potential but unknown strengths and low information conductivity into the global system), note that China suffered one of the biggest market declines despite the fact that foreigners are not allowed to trade in its stock markets to any significant extent. How can that be if the crash is simply contamination from U.S. housing? Pakistan too has suffered a dramatic fall, despite the lack of importance, I suspect, of U.S. housing securities on the Karachi exchange. The U.S. and the U.K., in contrast, despite being the epicenter of the housing bubble, had (relatively) modest declines.

What is going on is, as I have said before, an information problem, not a liquidity problem. Only by discovering the information many want but few have - information about which ventures undertaken during the great bubble are sustainable, and which were errors; about where, in other words, the remaining unexploded economic bombs lie - can order be restored.

But why let the data get in the way of a good political fable?

Think again. Oh, it's true that the US housing market developed a bubble. As I have noted here , that is because of the politicization of housing loans by the federal government, which made lenders' job difficult. But it is also true, as I've argued here, that the crash is more likely a function of the global boom that unfolded, depending on one's preferred starting point, in 1982, 1991 or 1998. This boom was profound, changing hundreds of millions of lives, but ended the way such booms always do, with a backlog of mistaken ventures in need of cleaning out. At worst, the U.S. housing bubble was nothing more than the needle that popped the bubble that particular day.

Can this be? Below is a chart that links two numbers. On the vertical axis is the percentage fall in stock markets around the world in 2008. On the horizontal is the country's rating for clean governance by Transparency International, an anti-corruption group.

">

">Note the close relationship between lack of transparency (i.e., more corruption) and the size of the fall. Indeed, the correlation between the two quantities for the 28 countries I arbitrarily chose (because market data were easily available) is 0.69, which in social science is very large.

So what does it mean? In any society economic actors make mistakes relative to what they know after the fact. In societies with a lot of corruption (which masks information, because each government bribe is by construction hidden from the investing public) or with miserable accounting or other problems with financial information the number of such mistakes over any interval is larger. Thus, this crash is a major cleaning out of a large pile of accumulated mistakes, not an outburst of irrationality or the residue of some strangely unprecedented spasm of greed. The correlation would undoubtedly be even more impressive if it used the quality of financial reporting and information instead of overall government transparency, but is very informative as it is.

For more evidence that this is a rational resolution of a rational bubble (driven by the emergence of many countries with great potential but unknown strengths and low information conductivity into the global system), note that China suffered one of the biggest market declines despite the fact that foreigners are not allowed to trade in its stock markets to any significant extent. How can that be if the crash is simply contamination from U.S. housing? Pakistan too has suffered a dramatic fall, despite the lack of importance, I suspect, of U.S. housing securities on the Karachi exchange. The U.S. and the U.K., in contrast, despite being the epicenter of the housing bubble, had (relatively) modest declines.

What is going on is, as I have said before, an information problem, not a liquidity problem. Only by discovering the information many want but few have - information about which ventures undertaken during the great bubble are sustainable, and which were errors; about where, in other words, the remaining unexploded economic bombs lie - can order be restored.

But why let the data get in the way of a good political fable?

Labels: Economics, Financial Crash, Globalization

0 Comments:

Post a Comment

<< Home