Dead Man's Hill

What caused the housing bubble? Greed, lack of regulation, or too much regulation?

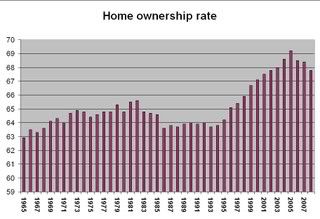

Below (a little fuzzy, unfortunately, but I think the story is clear) is a plot of home ownership rates in the U.S. from 1965-2008, from the Bureau of the Census (Table 14).

You can see that historically ownership rates fluctuated between 63-65%. But beginning in roughly 1994 they began a rise to historically unprecedented levels. What happened? Between 1993-7, particularly in 1994 (the Wikipedia history is a little fuzzy) the government increased pressure on banks in a variety of ways to lend to those who didn't get loans, particularly the poor and those in inner-city neighborhoods. This was a shock to the financial system - a changing of the rules that required lenders to reevaluate their risk exposure. Against traditional risks of nonpayment on one side had to be weighed new, unclear risks concerning the risk of government punishment for not meeting government targets about loans to politically favored but financially troubling borrowers.

Added into the mix was the decision by the Federal Reserve after Sept. 11 to loosen monetary policy dramatically. (We all remember how nervous everyone was about the economy after the attacks, with Wall Street falling badly on the day the markets reopened.) As much as economists like to think no one with rational expectations would fall for it, politicians know through their repeated use of the tactic that they can rely on money illusion to give the economy a short-term boost. And so easy credit followed easy money, and this combined poisonously with the CRA reforms to generate the pattern above. All financial bubbles have their roots in a combination of new developments and broad uncertainty, and that is what the CRA reforms, in combination with the new subprime mortgage-security instruments the financial industry developed to help companies navigate them, did. In hindsight it is clear that the bubble popped in 2006, and took much of the global economy (how much remains to be seen) with it.

The numbers do not lie. Markets correctly solve the problem of who should and shouldn't own a home, once we take cognizance of the fact that for some people to have a home will impose very large costs on others. This is a disaster made in Washington, by politicians for their short-term interests at the expense of the rest of us.

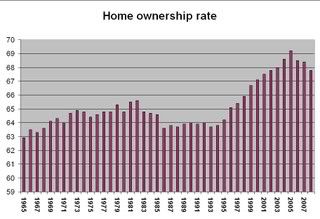

Below (a little fuzzy, unfortunately, but I think the story is clear) is a plot of home ownership rates in the U.S. from 1965-2008, from the Bureau of the Census (Table 14).

You can see that historically ownership rates fluctuated between 63-65%. But beginning in roughly 1994 they began a rise to historically unprecedented levels. What happened? Between 1993-7, particularly in 1994 (the Wikipedia history is a little fuzzy) the government increased pressure on banks in a variety of ways to lend to those who didn't get loans, particularly the poor and those in inner-city neighborhoods. This was a shock to the financial system - a changing of the rules that required lenders to reevaluate their risk exposure. Against traditional risks of nonpayment on one side had to be weighed new, unclear risks concerning the risk of government punishment for not meeting government targets about loans to politically favored but financially troubling borrowers.

Added into the mix was the decision by the Federal Reserve after Sept. 11 to loosen monetary policy dramatically. (We all remember how nervous everyone was about the economy after the attacks, with Wall Street falling badly on the day the markets reopened.) As much as economists like to think no one with rational expectations would fall for it, politicians know through their repeated use of the tactic that they can rely on money illusion to give the economy a short-term boost. And so easy credit followed easy money, and this combined poisonously with the CRA reforms to generate the pattern above. All financial bubbles have their roots in a combination of new developments and broad uncertainty, and that is what the CRA reforms, in combination with the new subprime mortgage-security instruments the financial industry developed to help companies navigate them, did. In hindsight it is clear that the bubble popped in 2006, and took much of the global economy (how much remains to be seen) with it.

The numbers do not lie. Markets correctly solve the problem of who should and shouldn't own a home, once we take cognizance of the fact that for some people to have a home will impose very large costs on others. This is a disaster made in Washington, by politicians for their short-term interests at the expense of the rest of us.

Labels: Economics, Financial Crash, Globalization

0 Comments:

Post a Comment

<< Home