Anti-Gouging

Are oil companies “gouging” the public? The charge is always a puzzling one, in that economically it must mean that oil companies exploit market power (deriving, as it must, from the limited availability of substitutes for their products) to earn supernormal profits. Immediately, one wonders: if oil companies have this kind of market power, why don’t they exploit it all the time? Why was gas so cheap in 1998? If they can raise prices to $2.80 a gallon because they are a “monopoly,” why not $4.00? Or $10.00?

As is so often true, Thomas Sowell gets to the heart of the matter. In a piece at Townhall.com, he notes the following:

The “something” is that, at the lower prices that used to prevail, the oil and gasoline desired by consumers exceeded the oil and gasoline offered by producers. Some way had to be found to reconcile that imbalance, and as usual, the price system did that effectively. As one final “As usual,” the whole Sowell piece is as usual worth a read. It prompts one to wonder why, if “windfall profits” taxes are such a good idea when oil prices are very high, why weren’t “windfall losses” subsidies equally compelling when gas was less than $1.00 a gallon eight years back?

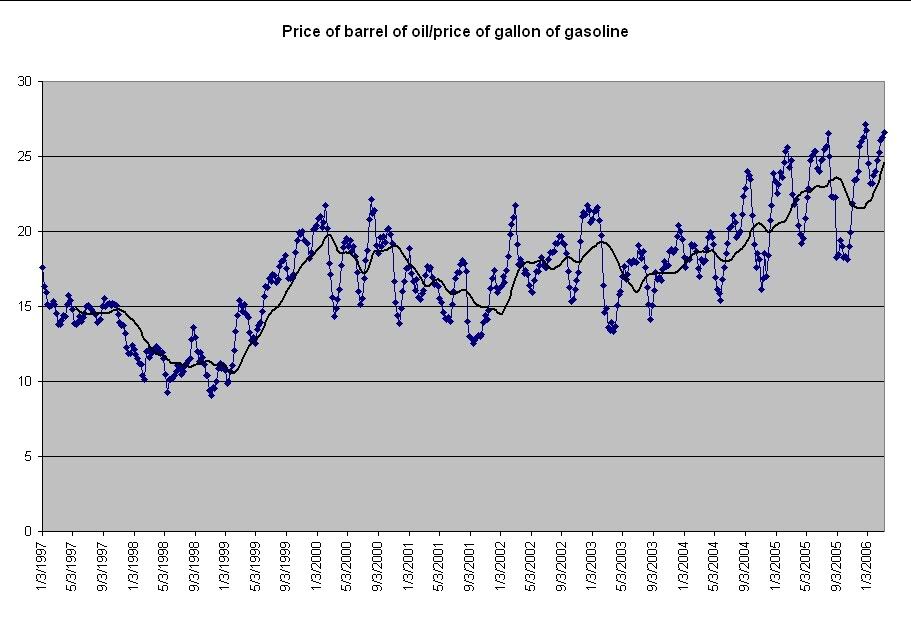

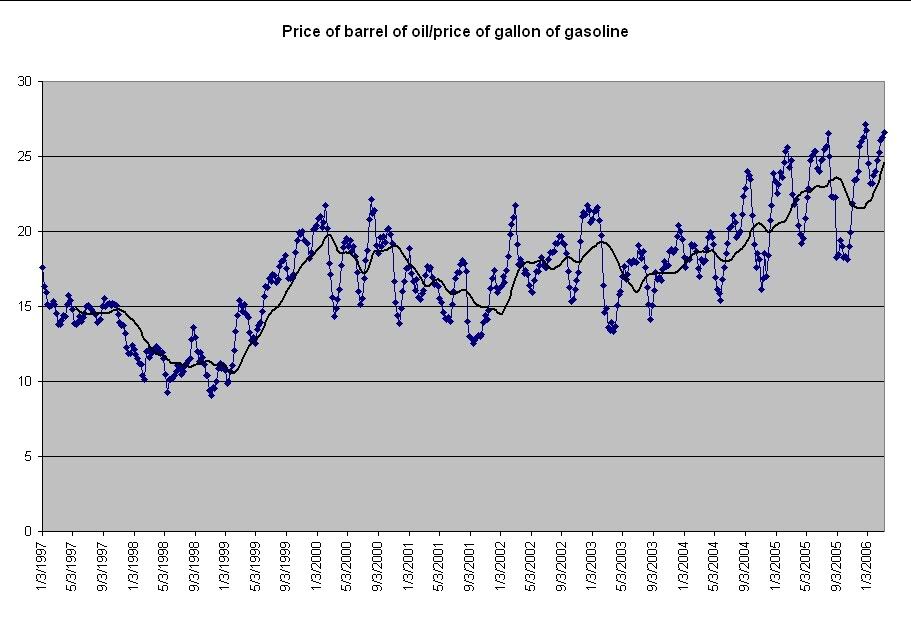

It is possible to get a proxy for the extent of “gouging” by dividing the price of a barrel of oil by the price of a gallon of gasoline. Time-series data going back to 1997 are available for both U.S. spot oil price and average U.S. gasoline prices for all grades and areas at the Energy Information Administration.

The chart below shows the result of dividing the price of a barrel of oil by that of a gallon of gasoline. I use current gasoline prices and lag oil prices by four weeks, thus assuming that it takes four weeks for oil-price changes to work through the oil-distribution system; using contemporaneous oil and gasoline prices makes no difference.

In fact, there has been a huge increase in this multiple in the last year and a half. What this means is that oil prices have increase more than gasoline prices in percentage terms. To think about it another way (by inverting numerator and denominator in the chart), in January of 2004 the price of a gallon of gasoline was 5.87 percent of that of a barrel of oil, but in March of 2006 it was only 5.17 percent. In fact, as oil prices have gone up oil companies have been forced by competition to squeeze more efficiency out of the production and distribution system for gasoline, despite Katrina, the increased demand in Asia that has forced Americans to bid harder against them for the scarce resources of oil and gas, and all the other facts which have undeniably caused higher prices. And this of course ignores the broader point that it is only because employees and shareholders of oil companies have risked a lot to begin with that there is any gasoline at all.

As far as I know the English language has no readily available antonym for "gouging." But maybe it should.

As is so often true, Thomas Sowell gets to the heart of the matter. In a piece at Townhall.com, he notes the following:

Are the oil companies charging all that the traffic will bear? No doubt. But they were probably charging all that the traffic would bear when the price of gasoline was half of what it is today.

Even businesses that are losing money are charging all that the traffic will bear. Otherwise they could raise their prices and stop losing money.

Most of the people who are making this claim are charging all that the traffic will bear for their own labor or the use of their own products. Dressing up the plain fact that we all usually prefer more to less in political rhetoric about "gouging" explains nothing. Something that is true all the time cannot explain drastic changes.

The “something” is that, at the lower prices that used to prevail, the oil and gasoline desired by consumers exceeded the oil and gasoline offered by producers. Some way had to be found to reconcile that imbalance, and as usual, the price system did that effectively. As one final “As usual,” the whole Sowell piece is as usual worth a read. It prompts one to wonder why, if “windfall profits” taxes are such a good idea when oil prices are very high, why weren’t “windfall losses” subsidies equally compelling when gas was less than $1.00 a gallon eight years back?

It is possible to get a proxy for the extent of “gouging” by dividing the price of a barrel of oil by the price of a gallon of gasoline. Time-series data going back to 1997 are available for both U.S. spot oil price and average U.S. gasoline prices for all grades and areas at the Energy Information Administration.

The chart below shows the result of dividing the price of a barrel of oil by that of a gallon of gasoline. I use current gasoline prices and lag oil prices by four weeks, thus assuming that it takes four weeks for oil-price changes to work through the oil-distribution system; using contemporaneous oil and gasoline prices makes no difference.

In fact, there has been a huge increase in this multiple in the last year and a half. What this means is that oil prices have increase more than gasoline prices in percentage terms. To think about it another way (by inverting numerator and denominator in the chart), in January of 2004 the price of a gallon of gasoline was 5.87 percent of that of a barrel of oil, but in March of 2006 it was only 5.17 percent. In fact, as oil prices have gone up oil companies have been forced by competition to squeeze more efficiency out of the production and distribution system for gasoline, despite Katrina, the increased demand in Asia that has forced Americans to bid harder against them for the scarce resources of oil and gas, and all the other facts which have undeniably caused higher prices. And this of course ignores the broader point that it is only because employees and shareholders of oil companies have risked a lot to begin with that there is any gasoline at all.

As far as I know the English language has no readily available antonym for "gouging." But maybe it should.

3 Comments:

Could you make that graph a little bigger... I'm having difficulty seeing it....

Sarcarsm noted. :) I'm pretty primitive when it comes to such things, so I'm not sure how to downsize it.

When you "upload" it...there should be an option for the size.

Now that it's in there, I'm not sure how to change the setting.

(I'm low tech, too)

Post a Comment

<< Home