The Senescent Society: Aging and the Economy in Germany and Japan

The Daily Telegraph reports that Germany appears to be sliding into the same sort of deflation/depression trap that has gripped Japan for years. Quoting a report by the HSBC firm, their reporter writes:

One of the more interesting stories of our time is the collapse into economic malaise of Japan and much of Europe since the end of the Cold War. Anatole Kaletsky, referring to the European half of this spectacular collapse, has described it as a “disaster almost unparalleled in modern history.” This is surely an overstatement, but there is something odd going on – sustained lack of growth in countries that have grown, other than during war or worldwide depression, for over a hundred years. Its causes are numerous, but one wonders if the aging of these societies is part of the story. The only honest answer is that we don’t know, because there has been little systematic research on the consequences of aging societies, other than the effects on state pension systems. So this is as good a place to start as any.

The standard macroeconomic model that every undergraduate economics major learns strongly suggests that depression and deflation could accompany the rapid aging of the European and Japanese populations. Contrary to the predictions of the economist Franco Modigliani in his work on consumption over the lifespan (which was part of why he won the Nobel Prize in 1985), it is apparently not true now (if perhaps it once was) that the elderly have a high propensity to consume. His belief was that most people save over their working lives and spend in their retirement. Aging therefore does not cause consumption to fall much, so that in the standard model (at least in the short term) an older society should not be a slower-growing society. Gary Becker in his household production model in 1965 implied that someone who is retired, because of declining productivity of time as an input into consumption, will substitute purchased goods for time and hence spending will go up. The retired couple who eats out a lot and cooks at home seldom is the classic example.

But that prediction is apparently not true. What a lot of elderly apparently do is to scrimp in fear of outliving their retirement savings, and save to leave substantial amounts of wealth to their children. One Federal Reserve Study indicates that about 70% of the elderly single population will die with a positive net worth, and that subset will by design spend $4000-$7000 less annually on consumption as a result.

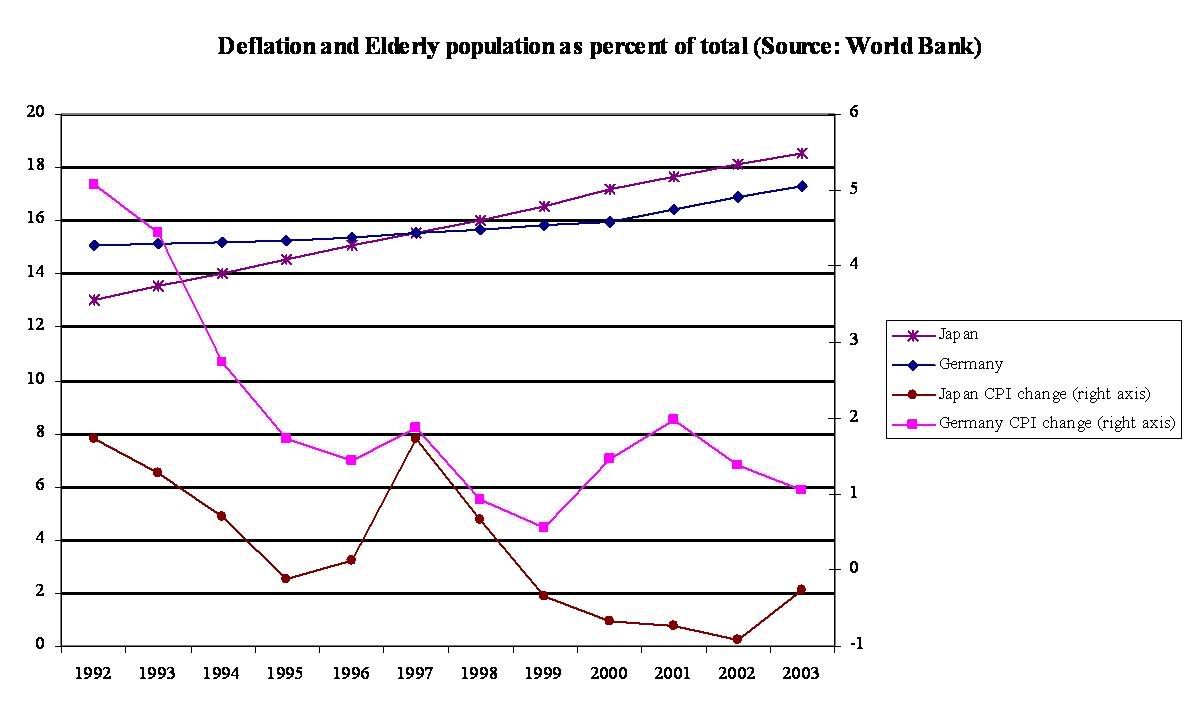

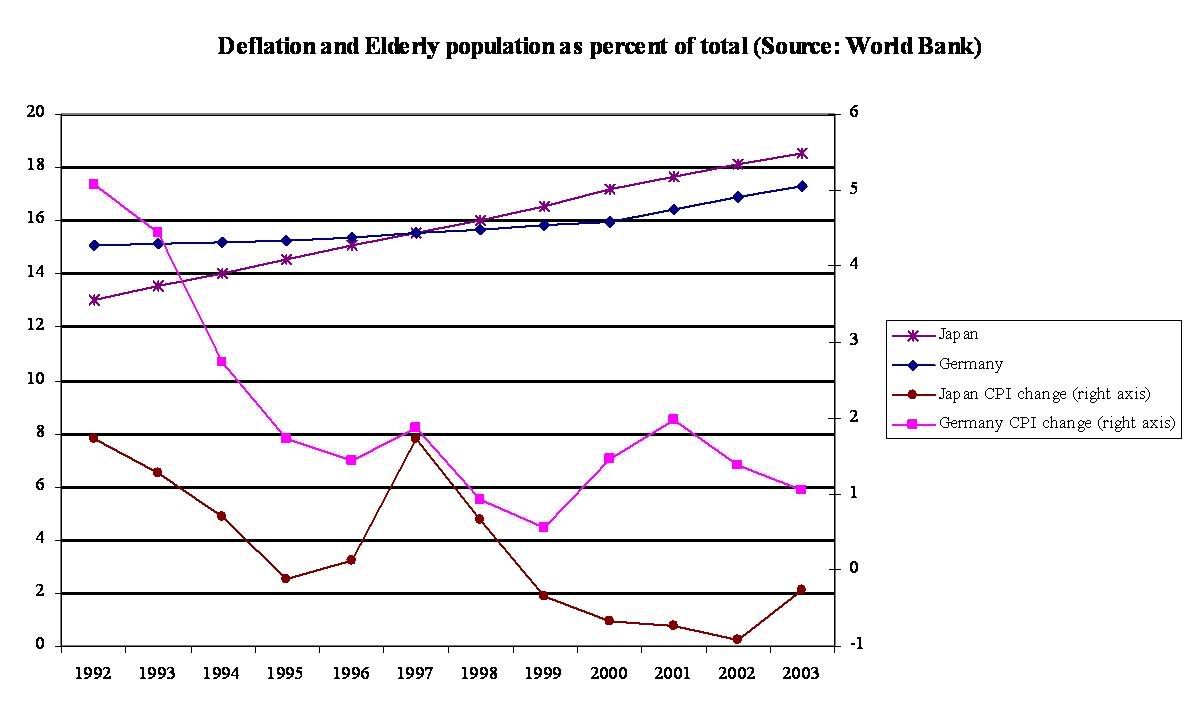

If one accepts that the elderly draw in their horns and become very conservative in their spending habits, then an older population becomes a reluctant population. If one believes that deflation happens because aggregate demand falls, then (if deflation is something that accompanies depression, which not everyone accepts) an aging population becomes a deflationary population. Collectively, we would expect to observe that as population ages the inflation rate falls (perhaps to below zero) and so does economic growth. And that is in fact what we may be observing. Below are the inflation rates and percentages of the population over 65 for Germany and Japan, two of the countries hardest hit by stagnation and aging:

This is admittedly not much to go on, and so one would be foolish to conclude too much from such a simple exercise. It is an interesting question whether aging populations become deflationary and depression-ridden, and whether therefore Germany and Japan are going now where other European countries with aging populations will soon follow. Of course, the textbook macroeconomic model, based on the old concepts of aggregate demand and supply, is of very limited usefulness for a social remaking as revolutionary as this, but it does to explain at least some of what we are seeing. (Another implication would be that older societies would have higher savings rates. A third is that railing against the European Central Bank for slow European growth is pointless.) This sort of Keynesian modeling of the problem does not even consider the increased expenditures on state pensions and the potential destruction of entrepreneurial creativity, topics for another time.

"Germany is perilously close to deflation. We believe it is only a question of time before there are generalised price falls in the country. This will in turn raise more questions about the rules governing EMU and the sustainability of the single currency itself."

The bank said the Netherlands and Italy were also in danger.

Italy was in "dire straits" after a "collapse" in productivity and negative growth for five out of the past nine quarters. "Italy has completely failed to adapt to the rigours of the fixed exchange rate," it said

…

The dreaded term "liquidity trap" was used by economist John Maynard Keynes in the 1930s when traumatised consumers and investors refused to spend, pushing prices ever lower.

Deflation renders conventional monetary policy impotent as it is impossible to cut interest rates below zero (though there are other methods). Inflation-adjusted rates rise as the crisis deepens, causing mass bankruptcy.

Germany and Holland may now be slipping into this trap. Their core inflation is around 0.7pc, but on a downward glide path.

One of the more interesting stories of our time is the collapse into economic malaise of Japan and much of Europe since the end of the Cold War. Anatole Kaletsky, referring to the European half of this spectacular collapse, has described it as a “disaster almost unparalleled in modern history.” This is surely an overstatement, but there is something odd going on – sustained lack of growth in countries that have grown, other than during war or worldwide depression, for over a hundred years. Its causes are numerous, but one wonders if the aging of these societies is part of the story. The only honest answer is that we don’t know, because there has been little systematic research on the consequences of aging societies, other than the effects on state pension systems. So this is as good a place to start as any.

The standard macroeconomic model that every undergraduate economics major learns strongly suggests that depression and deflation could accompany the rapid aging of the European and Japanese populations. Contrary to the predictions of the economist Franco Modigliani in his work on consumption over the lifespan (which was part of why he won the Nobel Prize in 1985), it is apparently not true now (if perhaps it once was) that the elderly have a high propensity to consume. His belief was that most people save over their working lives and spend in their retirement. Aging therefore does not cause consumption to fall much, so that in the standard model (at least in the short term) an older society should not be a slower-growing society. Gary Becker in his household production model in 1965 implied that someone who is retired, because of declining productivity of time as an input into consumption, will substitute purchased goods for time and hence spending will go up. The retired couple who eats out a lot and cooks at home seldom is the classic example.

But that prediction is apparently not true. What a lot of elderly apparently do is to scrimp in fear of outliving their retirement savings, and save to leave substantial amounts of wealth to their children. One Federal Reserve Study indicates that about 70% of the elderly single population will die with a positive net worth, and that subset will by design spend $4000-$7000 less annually on consumption as a result.

If one accepts that the elderly draw in their horns and become very conservative in their spending habits, then an older population becomes a reluctant population. If one believes that deflation happens because aggregate demand falls, then (if deflation is something that accompanies depression, which not everyone accepts) an aging population becomes a deflationary population. Collectively, we would expect to observe that as population ages the inflation rate falls (perhaps to below zero) and so does economic growth. And that is in fact what we may be observing. Below are the inflation rates and percentages of the population over 65 for Germany and Japan, two of the countries hardest hit by stagnation and aging:

This is admittedly not much to go on, and so one would be foolish to conclude too much from such a simple exercise. It is an interesting question whether aging populations become deflationary and depression-ridden, and whether therefore Germany and Japan are going now where other European countries with aging populations will soon follow. Of course, the textbook macroeconomic model, based on the old concepts of aggregate demand and supply, is of very limited usefulness for a social remaking as revolutionary as this, but it does to explain at least some of what we are seeing. (Another implication would be that older societies would have higher savings rates. A third is that railing against the European Central Bank for slow European growth is pointless.) This sort of Keynesian modeling of the problem does not even consider the increased expenditures on state pensions and the potential destruction of entrepreneurial creativity, topics for another time.

1 Comments:

prof premraj pushpakaran writes -- 2018 marks the 100th birth year of Franco Modigliani!!!

Post a Comment

<< Home